- Best Roof Financing Options

- How To Choose The Right Option For Your Situation

- Getting The Best Rates And Avoiding Problems

- Maximize Your Investment

- FAQs

The roofing contractor just left after walking through your Los Angeles home. The estimate is $22,000. You have maybe $3,000 saved up, and the rainy season is two months away.

The truth is you’re not alone.

Most LA homeowners don’t have enough money in their bank account waiting for a roof emergency. Yet the good news is that there is roof financing, and you have more options than you might think.

With various financing options available, you don’t have to wait for the roof you need. By exploring your options, you can make the investment in your home today and enjoy peace of mind, knowing you’re covered no matter what the weather brings.

Key Takeaways

- Roof financing can help you cover the cost of a new roof, even if you don’t have all the funds upfront.

- Contractor-offered financing is often the fastest and most affordable option.

- PACE financing offers long-term, low-payment solutions without a credit check.

- Home equity loans and HELOCs provide low interest rates for homeowners with equity.

- Personal loans offer flexibility, but typically come with higher interest rates.

- Government loans like FHA Title 1 loans are available for homeowners with limited equity or credit.

- Check with your insurance before financing to see if roof damage is covered.

- Take advantage of rebates, tax credits, and off-season scheduling to save money on your roof replacement.

Best Roof Financing Options

When it comes to financing a new roof, homeowners have several options to choose from. Whether you’re looking for low monthly payments, long-term financing, or quick approval, understanding the best options available can help you find a solution that fits your budget and needs. Below, we’ll explore some of the top roof financing choices to consider for your next roof replacement project.

Contractor-Offered Financing

Can you finance a roof through your roofing contractor? Absolutely, and it’s often the smartest choice. Experienced contractors partner with lenders who specialize in home improvement financing. You apply through your contractor, get approved within a day or two, and the funds are deposited directly into your project.

They also negotiate volume deals with lenders, which means better rates for you than going to a bank on your own. The process is fast, there are usually no separate closing costs, and many contractors offer promotional periods with zero percent interest for 12 to 24 months.

We can help you find the best roof solution for your budget.

Get a quote

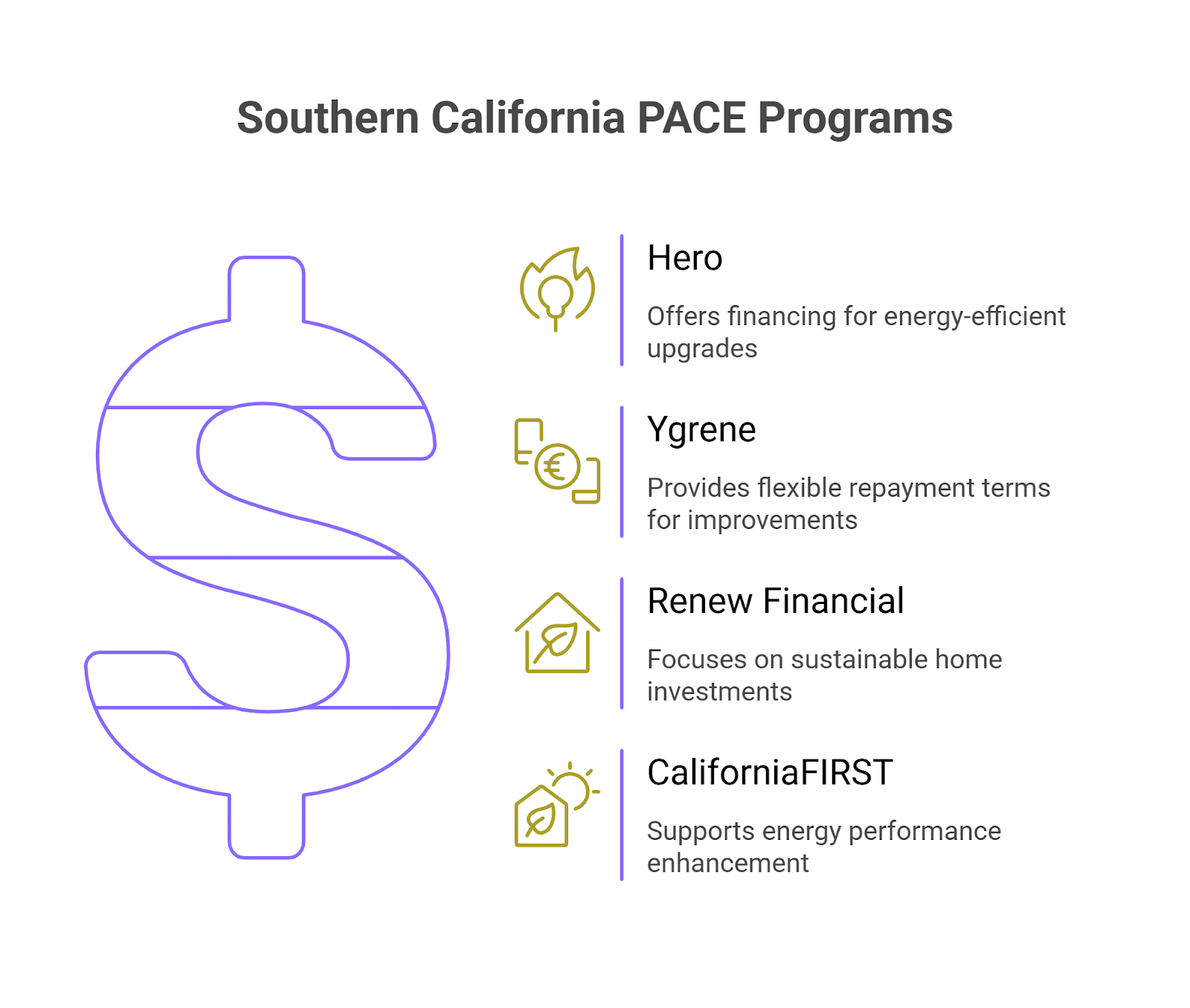

PACE Financing

If you live in California and haven’t heard of PACE financing, you’re missing out on one of the best roof replacement financing options available. PACE (Property Assessed Clean Energy) is a game-changer for homeowners who need long-term, low-payment financing.

Here’s how it works: the loan is attached to your property, not to you personally. You repay it through your property tax bill over 10 to 25 years. If you sell your home, the new owner takes over the payments. The best part is that many PACE programs don’t require a credit check. They qualify you based on your home.

PACE creates a property tax lien that takes priority in foreclosure proceedings. It can also complicate home sales since some buyers resist taking over PACE payments. But if you’re planning to stay in your home for at least five years and want the lowest possible monthly payment, PACE financing is hard to beat.

Home Equity Options

If you’ve built up significant equity in your home, at least 20% of your home’s value, you have access to some of the lowest interest rates available through home equity loans or home equity lines of credit (HELOCs).

A HELOC works like a credit card secured by your home. You get approved for a credit line, draw what you need for your roof, and pay interest only on what you use.

This is the best for homeowners who want the lowest rates, have substantial equity, and are comfortable using their home to secure the loan.

Personal Loans

What if you don’t have much home equity, or you’re uncomfortable putting your house up as collateral? Personal loans solve both problems. These are unsecured loans from banks, credit unions, or online lenders. No collateral required, and you can often get approved the same day.

Interest rates depend on your credit score and typically range from 6% to 15%. Terms run 3 to 7 years, and you can borrow $5,000 to $100,000. Most personal loans have no closing costs, which makes them straightforward.

The disadvantage is higher interest rates compared to home-secured loans and shorter terms, which means higher monthly payments. Your credit score matters a lot here. If you have excellent credit (740+), rates will be competitive. Fair credit (640-680) means higher rates.

Government Loans For Roof Replacement

The federal government offers FHA Title 1 loans specifically for home improvements. These government-backed loans are designed to help homeowners who might not qualify for conventional financing.

Here’s what makes them special: no minimum credit score requirement, no equity needed for loans under $7,500, and you can borrow up to $25,000 with fixed interest rates. You just need to have lived in your home for at least 90 days and keep your debt-to-income ratio below 45%.

The process is more involved than other options and takes longer (4 to 8 weeks typically), but if you have limited equity or are rebuilding credit, this can be your path to financing when other doors close.

Free Roof Replacement Programs And Assistance

While truly free roof replacement programs are rare, some assistance exists for homeowners facing financial hardship. These programs target low-income households, veterans, disabled individuals, and seniors who genuinely need help.

The Weatherization Assistance Program (WAP) through the U.S. Department of Energy helps low-income families with energy efficiency improvements, which can include roofing work.

The USDA Rural Development program offers grants up to $10,000 and loans up to $40,000 for home repairs in rural areas, though most of Los Angeles doesn’t qualify.

Veterans have access to specific programs through the VA, including home improvement grants and specially adapted housing grants, depending on disability status.

These programs have strict income requirements and long waiting lists. They’re not quick solutions, but if you qualify, they can provide crucial assistance when you have no other options.

Insurance Coverage

Before you finance anything, check whether your homeowners’ insurance covers the damage. If your roof failed due to a covered event, storm damage, fire, hail, or a fallen tree, insurance should pay for replacement minus your deductible.

As a rule, insurance doesn’t cover normal wear and tear, age-related failure, or damage from lack of maintenance. But if a storm hits and damages your roof, file a claim within 30 to 60 days. The insurance company sends an adjuster, assesses the damage, and issues payment.

Also, read:

How To Choose The Right Option For Your Situation

Your best choice depends on your specific circumstances. Here’s a quick decision guide.

Getting The Best Rates And Avoiding Problems

When applying for roof financing, preparing properly can make a big difference in securing the best rates and avoiding costly mistakes. Here’s how to improve your approval odds and navigate the process smoothly:

- Check your credit reports for errors 30 to 60 days before applying.

- Pay down credit card balances below 30% of your limit to improve your credit score.

- Avoid opening new accounts or making large purchases right before applying.

- Apply to three to five lenders within a 14-day window to minimize credit score impact.

- Have all your documents ready: pay stubs, tax returns, and bank statements.

- Be honest about your income and any credit issues to avoid delays or surprises.

- Tell lenders you’re comparing options and ask if they can match competitor rates.

- Look for small discounts, like those for automatic payments or existing customer benefits.

- Be wary of red flags that signal predatory lending, such as: pressure to sign immediately, unclear terms or hidden fees, promises of approval regardless of credit, interest rates over 20% (except credit cards)

- If a contractor offers to waive your insurance deductible, walk away; it’s insurance fraud.

By following these steps, you can increase your chances of securing financing on favorable terms and avoid common pitfalls. Careful preparation ensures you get the best deal while protecting your financial future. If you’re ready to explore your options, we’re here to guide you through every step of the process.

Cut Roof Replacement Costs With Smart Timing

Updating your roof doesn’t have to strain your budget. With the right timing and incentives, you can significantly lower your total project cost.

- Tap into savings by taking advantage of available incentives. LADWP offers cool roof rebates of up to $0.20 per square foot, helping lower your upfront costs. You may also qualify for federal tax credits when choosing energy-efficient roofing materials, just be sure to confirm eligibility with a tax professional.

- Choose the right season to get the best pricing on your roof replacement. Winter (Nov–Feb) is the slow season and often comes with 10%–15% lower rates, while spring and fall typically offer standard pricing. Summer is the busiest period, which means the highest costs. If your roof isn’t urgent, planning your project during slower months can lead to meaningful savings.

- Bundle for more value by combining projects like gutters, solar prep, or siding. Grouping these upgrades can save 15%- 20% while also making financing simpler and more cost-effective.

Smart timing, rebates, and bundled upgrades can help you reduce costs and get more value from your roof replacement.

Roof financing options give homeowners the flexibility to tackle necessary repairs and replacements without breaking the bank. Whether you choose contractor financing, PACE programs, or personal loans, each option offers benefits that can work for different situations. By staying informed about available programs, rebates, and strategic timing, you can minimize costs and maximize the value of your new roof.

At Roof Replacement Inc., we specialize in high-quality roof replacements and repairs tailored to your specific needs. We know roofing projects are a major investment, which is why we try to keep your project affordable and stress-free. Our team supports you through every step:

- Energy-efficient cool roofs can help lower utility bills and improve comfort

- Roof repair services for issues that need fast attention

- New roof installations designed for long-term durability

- Roof replacement and installation that restores and protects your home

Get a quote

FAQs

Which financing option is best for me?

The best financing option depends on your financial situation, credit score, and whether you have equity in your home. If you’re looking for lower interest rates and have substantial home equity, a home equity loan or HELOC might be ideal. If you need long-term, low-payment financing, PACE financing could be a better option. Contractor financing is a quick and easy choice for those who prefer an all-in-one solution with a streamlined process.

Can I qualify for roof financing with a low credit score?

Yes, you can qualify for financing even with a low credit score. Programs like PACE financing are based on the value of your home rather than your credit score, making it easier for homeowners with less-than-perfect credit to secure financing. Additionally, FHA Title 1 loans offer financing with no minimum credit score requirement, especially for those with limited equity or rebuilding credit.

Does financing cover the entire cost of a roof replacement?

Yes, many financing options can cover the full cost of a roof replacement, including labor and materials. However, the terms of your financing and the type of loan you choose may affect how much is covered and what out-of-pocket expenses remain. For example, if insurance covers part of the cost, you might only need financing for the remaining balance.

What happens if I can’t make my financing payments?

If you fall behind on your roof financing payments, the consequences depend on the type of loan you have. For home equity loans, the lender could foreclose on your home. With PACE financing, the loan is tied to your property taxes, so missed payments could result in a lien on your property. It’s essential to understand the terms and consequences of any financing option before committing, and contact your lender if you’re struggling to make payments.

Can I combine multiple financing options for my roof replacement?

Yes, it’s possible to combine different financing options to help cover the full cost of your roof replacement. For example, you could use PACE financing for the long-term portion of the price and a personal loan or contractor financing for any additional expenses. Combining financing options can offer greater flexibility and allow you to find the best deal for your budget.

What Our Clients Say

Roof Replacement Inc. offers professional, high-quality work, guaranteed (call for details); ensuring all clients projects meet all code and design requirements. We are dedicated to exceptional customer service and will strive to ensure you with the highest quality roofing services. Roof Replacement Inc. offers lifetime warranty (call for details) on all of our workmanship to ensure the quality of our work. With over four decades of experience and success within the roofing and construction industry, Roof Replacement Inc. has grown and developed in all areas of roofing construction, including roof inspections. As a leading residential and commercial roofing company in LA, we have hundreds of references from previous clients, so rest assured, that your roofing job will be done right the first time. Replacing an old roof can help add curb appeal and will increase the perceived value of your home. First impressions are vital when selling your home, especially when your roof takes up more than half of the exterior of your residence or business. Not only is the return of investment on a new roof attractive for potential buyers, but can be as beneficial as remodeling the kitchen or bathrooms within your residence.